How does crypto arbitrage work?

For crypto arbitrage to work, you need to have active trading accounts with at least two crypto exchanges (i.e Okx.com and Mexc.com).

The more the better as you can find more arbitrage opportunities between different exchanges.

To get started, you need to determine an asset you want to find arbitrage opportunities for (i.e BTC/USDC). To keep things simple, let’s take Bitcoin as an example. The starting point of a crypto arbitrage model is making sure you have available Bitcoin on one of the exchanges and USDC stablecoin on the other exchange.

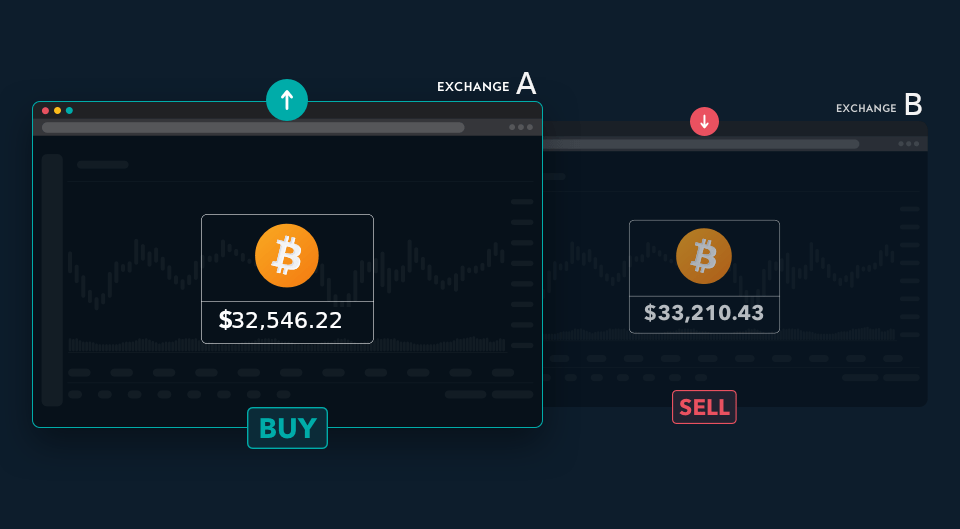

Now, when this setup is in place, we can start looking for price differences as often as possible right through the day. For example, the price of Bitcoin at exchange A is 2% lower than the price at exchange B. To profit from this difference, we decide to simultaneously execute the following two orders:

- Buy 1 Bitcoin at exchange A

- Sell 1 Bitcoin at exchange B

This double trade allowed us to buy bitcoin low at exchange A and sell high at exchange B, we sold our Bitcoin at a higher price at exchange B after buying one Bitcoin at a 2% lower price at exchange A. To conclude, in this example we were able to make a 2% profit by trading across different exchanges.

However, do not forget to incorporate the trading fee for both exchanges when calculating the price difference. As you are executing two trades, you are paying twice for trading fees. Otherwise, you’ll end up with a lower balance than when you got started, it is also wise to factor in withdrawal fees if you plan to withdraw across the two exchanges to increase liquidity during a trend.

Next, which crypto arbitrage model types are offered by ArbHodL?

Which crypto arbitrage model types exist?

- Cross Exchange Arbitrage (also known as Spatial Arbitrage)

- Single Exchange Three Coin Pairs Arbitrage (also known as Triangular Arbitrage)

What is Cross Exchange Arbitrage?

Trading of crypto across two different exchange platforms (i.e Okx.com and Mexc.com).

Arbitrage among different exchanges, with the revolutionary new ArbHodL bot, now you can take advantage of the big price differences between exchanges. A trading method that has proved to be incredibly effective in the crypto market. Cross Exchange Arbitrage consists of buying a coin in an exchange and selling it on another exchange where the pair is more expensive. Profiting from this difference and increasing the entire Hodl’s value.

What is Single Exchange Three Coin Pairs Arbitrage?

Single Exchange Three Coin Pairs Arbitrage looks for price opportunities for a single asset. Single Exchange Three Coin Pairs Arbitrage focuses on finding arbitrage opportunities between three different assets on a single exchange.

Single Exchange Three Coin Pairs Arbitrage opens up many more possibilities as exchanges often have a large number of available trading pairs for assets such as Bitcoin, Ethereum, or Ripple. Some of those arbitrage pairs are not actively used which allows for bigger price differences where you can profit from.

To give an example, assume the following chain of trading pairs:

- BTC/USDC

- ETH/USDC

- ETH/BTC

First, start the chain of trades with one asset to which we will return at the end of the Single Exchange Three Coin Pairs Arbitrage loop. In this case, let’s start again with Bitcoin. We want to trade Bitcoin for USDC stablecoin, USDC for Ethereum, and lastly, Ethereum for Bitcoin again. The goal of this chain of trades is to end up with more Bitcoin than we started with by taking advantage of pricing differences between the different assets.

Again with this model type, watch the cost of fees as you are performing multiple trades that can eat up your potential profits.

How to get started with crypto arbitrage?

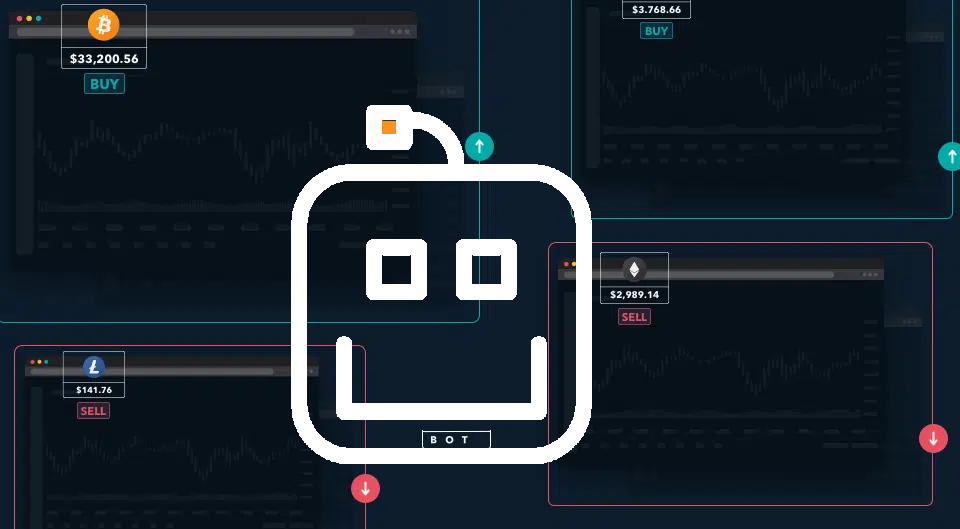

Manually looking for crypto arbitrage opportunities is possible but not recommended. It’s not a very scalable approach to manually monitor the markets 24/7 to find possible opportunities.

Furthermore, technological advancements have made it possible for regular users to benefit from trading bots that automate the arbitrage trading process. Chances are high that you will be outsmarted by ArbHodL, the Arbitrage bot which is 1000 times faster than humans.

What’s the risk of crypto arbitrage?

In essence, there’s no risk to Cross Exchange Arbitrage or Single Exchange Three Coin Pairs Arbitrage. ArbHodL does not withdraw any coin from your exchange, your funds remain safe on your exchange. ArbHodL never touches them directly and only uses official exchange APIs. The sole purpose of ArbHodL is to grow the balance of the crypto you hodl whenever you are not actively trying your luck in trading. During your downtime or sleep or lunch, just switch on ArbHodL and let it work while you rest or do something else. Of course, you are still exposed to the price volatility of the crypto you hodl.

However, the big risk many users oversee is the fee you have to pay for each trade at the exchanges. As you are doing two or even three trades, fees can eat up your potential profit. Therefore, make sure to calculate and include realistic trading and withdrawal fees on your arbitrage model. Another risk could be stuck orders, where the buy or sell order is placed and no one takes or matches it immediately at the exchanges, so this simply means you will just have to wait until the order is taken or matched, there is no loss unless you manually cancel the order yourself at the exchange.

Basically

You might wonder if crypto arbitrage is a bad thing? In the end, you are profiting from market price differences and not hurting any person financially. Therefore, it’s a great way to increase your hodl balance in a risk-free way.

Furthermore, Arbitrage isn’t a newly coined term, but ArbHodL is. The principle of ArbHodL works the same; buying low and selling high the same asset almost at the same time. ArbHodL only places orders where the price difference is positive as per your defined model in order to make a profit as per your defined model. ArbHodL gives you free 1BTC Arbitrage Volume to get you started risk free!